CFDs

Trade globally with Baxter Depo

CFD trading is defined as ‘the buying and selling of CFDs’, with ‘CFD’ meaning ‘contract for difference’. CFDs are a derivative product because they enable you to speculate on financial markets such as shares, forex, indices and commodities without having to take ownership of the underlying assets.

Instead, when you trade a CFD, you are agreeing to exchange the difference in the price of an asset from the point at which the contract is opened to when it is closed. One of the main benefits of CFD trading is that you can speculate on price movements in either direction, with the profit or loss you make dependent on the extent to which your forecast is correct.

Short and long CFD trading explained

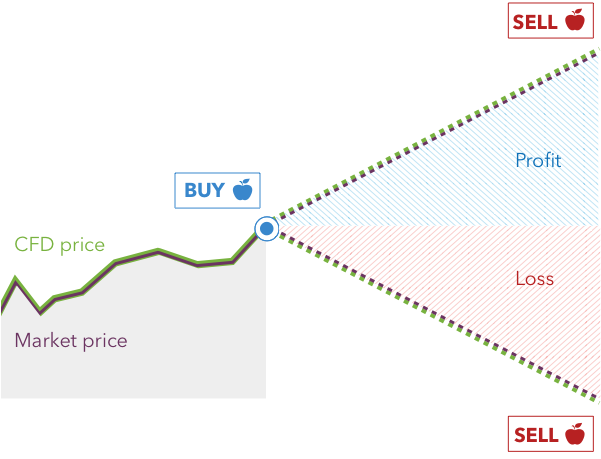

CFD trading enables you to speculate on price movements in either direction. So while you can mimic a traditional trade that profits as a market rises in price, you can also open a CFD position that will profit as the underlying market decreases in price. This is referred to as selling or ‘going short’, as opposed to buying or ‘going long’.

If you think Apple shares are going to fall in price, for example, you could sell a share CFD on the company. You’ll still exchange the difference in price between when your position is opened and when it is closed, but will earn a profit if the shares drop in price and a loss if they increase in price.

With both long and short trades, profits and losses will be realised once the position is closed.

Leverage in CFD trading explained

CFD trading is leveraged, which means you can gain exposure to a large position without having to commit the full cost at the outset. Say you wanted to open a position equivalent to 500 Apple shares. With a standard trade, that would mean paying the full cost of the shares upfront. With a contract for difference, on the other hand, you might only have to put up 5% of the cost.

While leverage enables you to spread your capital further, it is important to keep in mind that your profit or loss will still be calculated on the full size of your position. In our example, that would be the difference in the price of 500 Apple shares from the point you opened the trade to the point you closed it. That means both profits and losses can be hugely magnified compared to your outlay, and that losses can exceed deposits. For this reason, it is important to pay attention to the leverage ratio and make sure that you are trading within your means.

Margin explained

Leveraged trading is sometimes referred to as ‘trading on margin’ because the funds required to open and maintain a position – the ‘margin’ – represent only a fraction of its total size.

When trading CFDs, there are two types of margin. A deposit margin is required to open a position, while a maintenance margin may be required if your trade gets close to incurring losses that the deposit margin – and any additional funds in your account – will not cover. If this happens, you may get a margin call from your provider asking you to top up the funds in your account. If you don’t add sufficient funds, the position may be closed and any losses incurred will be realised.

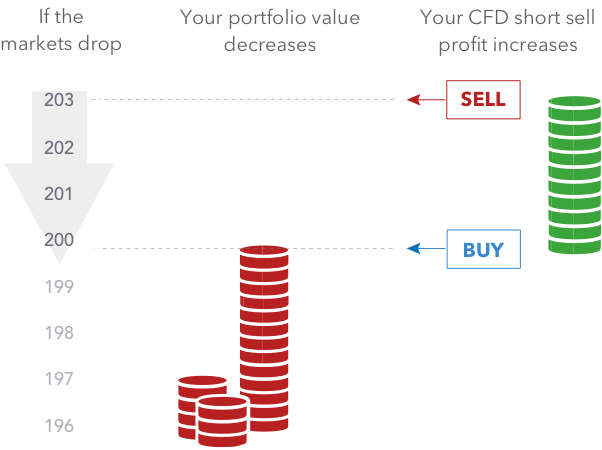

Hedging with CFDs explained

CFDs can also be used to hedge against losses in an existing portfolio.

For example, if you believed that some ABC Limited shares in your portfolio could suffer a short-term dip in value as a result of a disappointing earnings report, you could offset some of the potential loss by going short on the market through a CFD trade. If you did decide to hedge your risk in this way, any drop in the value of the ABC Limited shares in your portfolio would be offset by a gain in your short CFD trade.

Check out our Shares offer

| Name | Initial Deposit |

|---|---|

| Apple Inc CFD | 10% |

| Alibaba CFD | 10% |

| Facebook CFD | 10% |

Trade -globally with Baxter Depo

Get ultra-competitive spreads and commissions across all asset classes. Receive even better rates as your volume increases.

Register

Fill in your personal details in our secure online application.

Deposit

Make a deposit via debit card, wire transfer, eCheck or check.

Trading

Once your approved, you can trade on desktop and mobile.